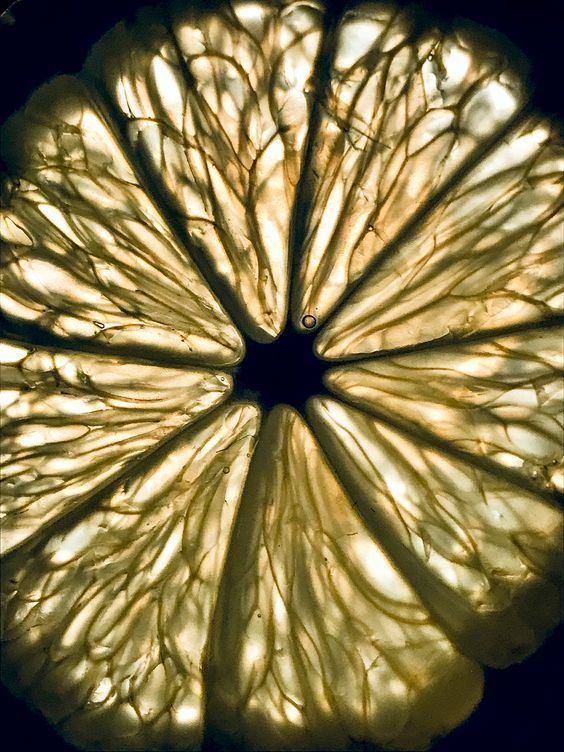

So, you’ve found yourself in a situation where you’ve purchased something, only to realize it’s not quite what you thought it would be. This feeling is commonly known as buyer’s remorse, and it’s especially prevalent when buying used cars. But fear not, there are ways to avoid this lemon of a situation.

How to Avoid Buying a Lemon Car:

1. Do Your Research: Before even stepping foot onto a car lot, it’s essential to do your research. Look up the make and model of the car you’re interested in and read reviews from other buyers. This will give you an idea of any common issues or complaints with that particular car.

2. Get a Vehicle History Report: A vehicle history report can provide you with information about the car’s past, including any accidents, title issues, or previous owners. This can give you a clearer picture of the car’s history and potential problems.

3. Have the car inspected by a mechanic: Before finalizing the purchase, have the car inspected by a professional mechanic. They can identify any potential issues that may not be easily noticeable to the untrained eye.

4. Test Drive: Always take the car for a test drive. Pay attention to how it handles, any strange noises, or warning lights that may appear on the dashboard.

5. Check the VIN: The Vehicle Identification Number (VIN) can reveal important information about the car, such as its production year, manufacturing location, and potential recalls.

The Case of the Lemon Bank Account:

When it comes to managing your finances, it’s essential to stay vigilant and be aware of any potential red flags. In the case of the lemon bank account, it’s important to regularly monitor your transactions and account balances to catch any discrepancies or unusual activity.

Recognizing the Signs of a Lemon Bank Account:

1. Irregular Transactions: Keep an eye out for any irregular transactions that you didn’t make. This could be a sign of fraudulent activity on your account.

2. Low Balances: If you notice unusually low balances in your accounts, it’s essential to investigate the cause. This could indicate unauthorized withdrawals or account errors.

3. Excessive Fees: Pay attention to any excessive fees or charges on your account statements. These could be a sign of hidden fees or errors in the bank’s accounting.

4. Lack of Customer Support: If you’re having difficulty reaching customer support or getting helpful assistance with your account, it may be a sign that the bank is not customer-friendly.

Taking Action Against a Lemon Bank Account:

If you suspect that your bank account is a lemon, it’s crucial to take action to protect your finances and personal information. Contact your bank immediately to report any suspicious activity or errors on your account. Additionally, consider switching to a more reliable and customer-friendly bank that prioritizes your financial well-being.

In conclusion, whether it’s a car or a bank account, no one wants to deal with a lemon. By staying informed, doing your research, and being proactive, you can avoid falling into a lemon of a situation. Stay vigilant and be aware of any potential red flags to protect your finances and investments. Remember, it’s better to be safe than sorry.

You can review our digital products by following us on Etsy.